Given the ongoing COVID-19 pandemic and the resulting changing legislative landscape, the state of commercial and residential evictions in California has been in what feels like a constant state of flux. Since March of this year, mandates and ordinances have been implemented at the state and local levels, rules have been adopted and withdrawn from the California judiciary, legislation was finally passed by the California legislature, and the Centers for Disease Control and Prevention (“CDC”) even chimed in in September. These changes have often led to more questions than answers.

Over the past several months, our Firm has put together multiple blog articles and webinars to summarize the ever-changing state of commercial and residential evictions in California, particularly in San Diego. As it stands now, however, the eviction guidelines that landlords and tenants should follow essentially boil down to two components: the recently passed California Assembly Bill 3088 and the CDC’s September 4, 2020 Order temporary halting evictions.

California’s Assembly Bill 3088

On August 31, 2020, after weeks of drafts, negotiation and compromises between lawmakers, tenant advocates and landlord organizations, Governor Newsom signed Assembly Bill 3088 into law, known officially as the Tenant, Homeowner, and Small Landlord Relief and Stabilization Act of 2020 (“AB 3088”). AB 3088 is a complicated and nuanced piece of legislation that is designed to protect residential tenants—not commercial tenants—who have faced, and continue to face, economic hardship due to COVID-19. As a result, with limited exceptions, the tenants within the scope of AB 3088 are those residential tenants who are facing eviction due to the non-payment of rent, and not those who are in material breach of other, non-monetary obligations of his or her lease.

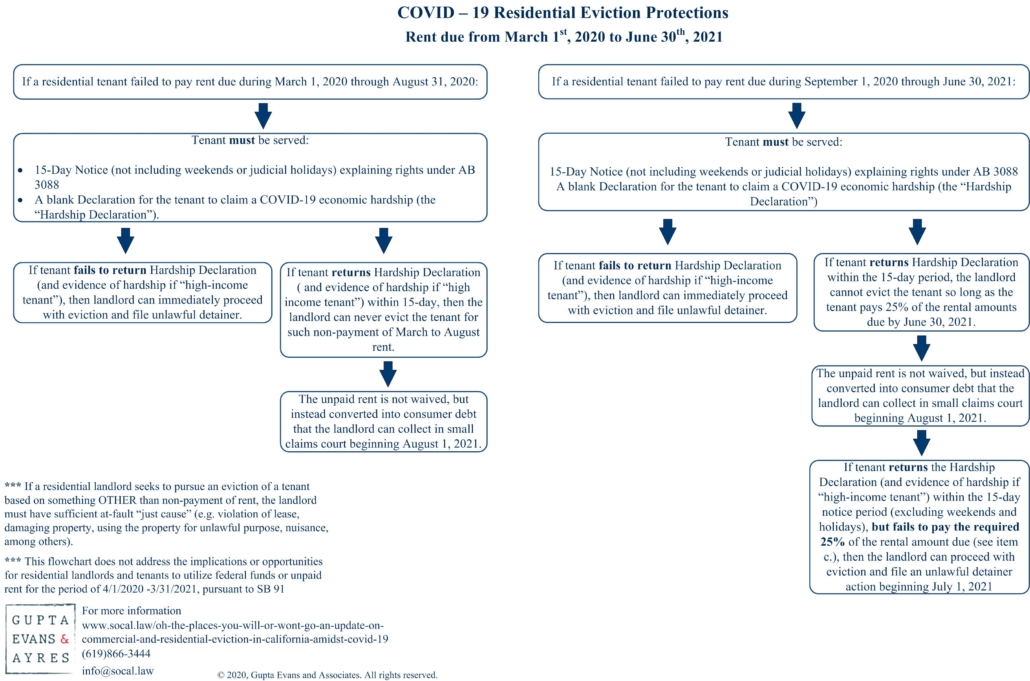

A simplified breakdown of AB 3088 can be found in this flowchart.

What About Commercial Tenancies?

Notably, and something to keep in mind throughout the remainder of this post, is that neither California’s Assembly Bill 3088 nor the CDC’s Order apply to commercial tenancies—only residential tenancies. Instead, on September 23, 2020, Governor Newsom issued Executive Order N-80-20 , which allows local governments to continue to impose commercial eviction moratoriums and restrictions, if such localities so choose, for commercial tenants who are unable to pay their rent because of COVID-19. This delegation of power will remain in place until March 31, 2021, if not longer.

As a result, commercial landlords and tenants looking for guidance on whether a commercial eviction can proceed should turn their attention to the respective eviction moratoriums in place, if any, at the city and county levels. For instance, the City of San Diego had its own eviction moratorium in place—applicable to both residential and commercial tenants—that set forth the specific rules and regulations that would either permit or prohibit a commercial landlord from pursuing the eviction of a commercial tenant. The City of San Diego’s eviction moratorium expired on September 30, 2020, however, and many commercial evictions have been able to move forward, with payment of any deferred rent currently due by December 30, 2020, unless extended.

If a commercial eviction moratorium remains in place at the city or county levels, such moratoriums typically apply exclusively to the non-payment of rent scenario, but landlords and tenants should carefully review each particular moratorium for the specific provisions, prerequisites and/or deadlines included in their respective moratorium, if any. As of the date of this posting, eviction moratoriums are currently in place in Southern California in, among other places, Los Angeles County and San Bernardino County. Notably, San Diego County does not have an overarching eviction moratorium in place; but, rather, such moratoriums, if any, are unique to the specific cities within the County.

AB 3088’s Application To Residential Tenancies

When considering the options and rights of both residential landlords and tenants under AB 3088, there are two time periods to keep in mind: (1) March 1, 2020 through August 31, 2020; and (2) September 1, 2020 through January 31, 2021. Each period dictates if, and when, a landlord can pursue an eviction of a residential tenant that has failed to pay rent, as follows:

- If a residential tenant failed to pay rent due during March 1, 2020 through August 31, 2020:

- Landlord must serve tenant with 15-Day Notice that explains the tenant’s rights under AB 3088 and provides a blank Declaration for the tenant to claim a COVID-19 economic hardship (the “Hardship Declaration”);

- If tenant fails to return the Hardship Declaration (and evidence of hardship if “high-income tenant”) within the 15-day notice period (excluding weekends and holidays), then the landlord can immediately proceed with eviction and file an unlawful detainer action (Note: be sure to include the new Supplemental Cover Sheet now required for all unlawful detainers—located here);

- If tenant returns the Hardship Declaration (and evidence of hardship if “high-income tenant”) within the 15-day notice period (excluding weekends and holidays), then the Landlord can never evict the tenant for such non-payment of rent. The unpaid rent is not waived, but instead converted into consumer debt that the landlord can collect in small claims court beginning March 1, 2021;

- If a residential tenant failed to pay rent due during September 1, 2020 through January 31, 2021:

- Like the above, the Landlord must serve tenant with 15-Day Notice that explains the tenant’s rights under AB 3088 and provides a blank Declaration for the tenant to claim a COVID-19 economic hardship (the “Hardship Declaration”);

- If tenant fails to return the Hardship Declaration (and evidence of hardship if “high-income tenant”) within the 15-day notice period (excluding weekends and holidays), then the landlord can immediately proceed with eviction and file an unlawful detainer action (Note: be sure to include the new Supplemental Cover Sheet now required for all unlawful detainers—located here); link: https://www.courts.ca.gov/documents/ud101.pdf]

- If tenant returns the Hardship Declaration (and evidence of hardship if “high-income tenant”) within the 15-day notice period (excluding weekends and holidays), then the Landlord cannot evict the tenant so long as the tenant pays 25% of the rental amounts due by January 31, 2021. The balance of unpaid rent is not waived, but instead converted into consumer debt that the landlord can collect in small claims court beginning March 1, 2021;

- If tenant returns the Hardship Declaration (and evidence of hardship if “high-income tenant”) within the 15-day notice period (excluding weekends and holidays), but fails to pay the required 25% of the rental amount due (see item c.), then the landlord can proceed with eviction and file an unlawful detainer action beginning February 1, 2021 (Note: be sure to include the new Supplemental Cover Sheet now required for all unlawful detainers—located here);

The foregoing is a relatively general and tremendously compressed explanation of AB 3088. A thorough review of the Bill’s intricacies is highly recommended. For instance, last year’s adoption of Assembly Bill 1482, which provided “just cause” protections to a limited number of residential tenants, has now been extended to all residential tenants until February 1, 2021, pursuant to AB 3088. A more detailed summary of AB 3088 can also be found in our previous blog post and webinar.

CDC’s Eviction Order

As if AB 3088 was not enough for landlords and tenants to get their heads around, the CDC issued its own eviction order just five days after AB 3088 on September 4, 2020 (the “CDC Order”). The CDC Order was issued to temporarily freeze evictions of residential tenants for the nonpayment of rent through December 31, 2020. In short, a tenant who wishes to rely upon the CDC Order must provide a declaration, under penalty of perjury, to the landlord certifying seven specific statements. A form declaration specifying the statements that can be used by tenants seeking the CDC Order’s protection can be obtained from the CDC’s website here.

The CDC Order has a shorter effective date than AB 3088 (prohibiting evictions until December 31, 2020 vs. potentially February 1, 2021), and presents significant concerns given the subjective and ambiguous nature of the CDC Order. For instance, one such statement that must be certified by the tenant is that he or she has used “best efforts” to obtain government assistance for rent or housing. This begs the obvious question—what are best efforts? The ambiguous nature of the language of the CDC Order invites potential disagreements between landlords and tenants about whether a tenant qualifies for the CDC Order’s protections, which may require the intervention of the Court to decide.

Notably, unlike AB 3088 and its mandated 15-day notice, there is nothing that requires the tenant to be made aware of the CDC Order or the tenant’s potential rights under the CDC Order. This fact, coupled with the existence and broad protections provided to residential tenants under AB 3088, make it unclear just how many residential tenants in California will actually rely upon the CDC Order (compared to states that do not have eviction protections in place). The CDC has provided a Frequently Asked Questions document that can further explain the scope and application provided by the CDC Order, which can be obtained here and is also highly recommended to review.

Conclusion

Commercial and residential landlords and tenants are facing an incredibly unique and unparalleled set of circumstances through the COVID-19 pandemic. The foregoing eviction protections implemented by California and the CDC have been enacted to try and combat not only the financial and economic stresses caused by the COVID-19 pandemic, but also the consequences of such stresses, such as being evicted from one’s home or office. That said, it is important to be cognizant of the fact that there are sure to be situations and instances that remain unaddressed, subject to dispute, or simply fall within the inevitable grey areas. Additionally, the interplay between local eviction moratoriums, AB 3088 and the CDC Order (or any other legislation that is ultimately passed) will unavoidably lead to conflicting language and further questions of uncertainty. The landscape will continue to shift, and landlords and tenants should continue to look for the most recent updates with respect to how best to proceed, or not proceed, in the context of evictions.

The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. Use of and access to this web site or any of the e-mail links contained within the site do not create an attorney-client relationship. The opinions expressed at or through this site are the opinions of the individual author and may not reflect the opinions of the firm or any individual attorney.